PRESS RELEASE

Emerging Europe M&A 2020 activity dampened but far from snuffed out; Slovakia experiences a steep drop in M&A

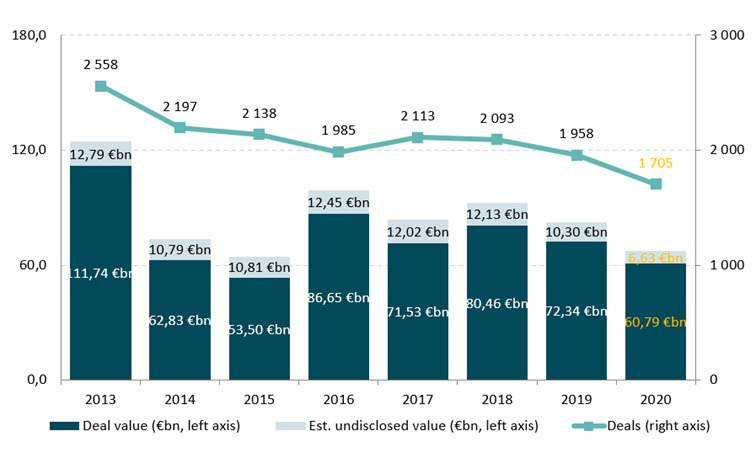

- Deal volume in emerging Europe dropped by 12.9% (1,705 deals) and total value by 16% (EUR 60.80bn) in 2020

- Value of IPOs reached EUR 4.79bn – the second highest on record

- Private equity deals accounted for 18.7% of total volume of deals

- Telecoms & IT overtook Real Estate & Construction as the busiest sector by deal volume with 333 deals in 2020 (an increase of 11% from 2019)

- Finance & Insurance saw an increase in deals by 8.6%

- Slovakia experiences the lowest number in deals in more than a decade (30)

- Poland was the sole country in the region to see growth in both deal volume (9.3%) and value (6.6%)

M&A activity in emerging Europe took a hit in 2020 as a result of the coronavirus pandemic with the volume of deals reaching its lowest levels in the past 10 years. There were 1,705 deals with a combined value of EUR 60.80bn, down by 12.9% and 16% respectively from 2019. In spite of the ongoing restrictions, the market showed signs of recovery towards the end of the year, producing the highest fourth-quarter deal value (EUR 24.28bn) since 2016.

Echoing similar sentiment, Stefan Stoyanov, Head of M&A Database at EMIS, says: “Despite Covid-19’s devastating impact on 2020, the emerging Europe region proved to be very resilient and outperformed other places similarly affected by the pandemic. There were key strategic deals featuring foreign investors in many of the region’s countries we reviewed, and private equity activity remained robust.”

Regional differences and situation in Slovakia

The CMS report highlights that while the impact of the economic slowdown was relatively evenly spread across the region, a number of countries bucked the trend. Poland was the only country where both deal volume and value rose in 2020 – 9.3% to 282 deals and 6.6% to EUR 11.7bn, respectively. The country saw two landmark deals: the EUR 3.7bn purchase of Poland’s mobile operator Play Communications by France’s Iliad which was the largest Telecoms & IT deal, and Allegro’s IPO, the biggest company to list on the Warsaw Stock Exchange.

Usually a stalwart in the M&A market, Czech Republic saw deal volumes fall by 24.7% and by 51.7% in values. Slovakia recorded 30 transactions with a total value of EUR 250 million, reaching the lowest number of deals in more than a decade.

Real estate and construction and Manufacturing were the busiest sectors (7 deals each), followed by investments in Finance & Insurance and Telecoms & IT (4 deals each). The largest investment last year was the acquisition of five logistics and industrial properties by the Arete. In the energy sector, the largest investment was the sale of a minority stake in VSE Holding to the German concern E.ON, while the financial sector saw the sale of the Slovak branch of AXA to Austrian Uniqa Insurance Group.

Capital markets bounce back, PE holds steady

In what mirrored a global trend, there was a revival of investor confidence in the capital markets with 26 companies from the emerging Europe region listing for the first time, reaching a total value of EUR 4.79bn. This was almost double the 14 IPOs in 2019 and represents the highest number of IPOs since 2015.

Private equity deal flow seemed to have withstood the difficult market conditions of 2020, and while cautious at times, held steady with 319 transactions (318 in 2019) and a decrease in value by 11.1% from 2019. The financial services sector saw the biggest jump in the number of private equity deals, up from 15 in 2019 to 33 in 2020. Since CMS first published the report, private equity funds have consistently grown their share of M&A in the region: in 2011, it accounted for 6% of the total volume of deals, rising to nearly one-fifth (18.7%) in 2020.

Graham Conlon, Head of Private Equity for CEE/CIS at CMS, says: “We haven’t seen any change in the appetite of private equity funds and anecdotally they were busier than ever in the second half of 2020. They have a life cycle and are committed to spending a certain amount from their funds over a period of time.”

Foreign investors cautious but regional ones defy the odds

Foreign investors were more cautious as reflected by cross-border M&A deal numbers decreasing by 34.3% to 764 and values falling by 31.5% to EUR 35bn. The US remained the largest foreign investor by volume, despite a 23% drop to 94 deals, while UK investors were the second most active with 72 deals, followed by Germany with 61 deals.

The opposite was true of domestic deal activity within countries in emerging Europe. Domestic deal numbers jumped 18.4% to 941 and 21.2% by value to EUR 25.8bn. Companies from Russia, Poland, Turkey and Czech Republic were the busiest dealmakers from within the region both in their own markets and abroad.

Leading sectors

Telecoms & IT was the most active sector by volume with 333 deals (up from 300 in 2019) and second by value at EUR 12.97bn, driven by the rapid acceleration of digitization and adoption of digital communications caused by the pandemic. The sector accounted for six of the 20 largest deals in region, including the third largest of all, the EUR 3.7bn purchase of Poland’s Play Communications by France’s Iliad.

Mining (incl. oil & gas) was the top sector by value at EUR 14.1bn despite falling deal volumes. While Real Estate & Construction dropped to second place by deal volume and third by deal value, the logistics and warehousing sub-sector saw a 38.5% increase in deals (from 39 to 54) in 2020, a trend demonstrating the need to support the growth in e-commerce.

The financial sector enjoyed 12 additional deals and a 39% rise in values, lifted by some of the region’s largest transactions including the purchase of the regional businesses of AXA by Uniqa Insurance of Austria and those of Aegon by Vienna Insurance Group.

Outlook for 2021

Horea Popescu, CEE Corporate practice, CMS, comments: “Towards the end of 2020, we saw people rushing to sign deals that they had been unable to complete earlier in the year. We saw this trend pick up in the autumn and there is a decent pipeline of activity in most countries which is a good sign for 2021.”

Market leaders will look to strengthen their position, while M&A targets will come from among distressed businesses, turnaround opportunities, private investors exiting the market or selling temporarily held assets, and companies reassessing strategies to part with non-core assets. Privatisation trends will accelerate in transition economies as they are moving along the EU accession path. Financial markets will face greater concentration, particularly in the banking sector, due to capital market fluctuations and an increase in non-performing loans and bad debts.”

The CMS Emerging Europe M&A 2020 report can be found here.

—————–END—————–

For further information, please contact:

Erik Werkman, Head of BD

E: erik.werkman@cms-cmno.com

T: +420 296 798 701

Notes to editors:

Founded in 1999, CMS is an integrated, multi-jurisdictional organisation of law firms that offers full-service legal and tax advice. With more than 70 offices in over 40 countries across the world and more than 4,800 lawyers, CMS has long-standing expertise both in advising in its local jurisdictions and across borders. From major multinationals and mid-caps to enterprising start-ups, CMS provides the technical rigour, strategic excellence and long-term partnership to keep each client ahead in its chosen markets.

The CMS member firms provide a wide range of expertise across 19 practice areas and sectors, including Corporate/M&A, Energy & Climate Change, Funds, Life Sciences & Healthcare, TMC, Tax, Banking & Finance, Commercial, Competition & EU, Dispute Resolution, Employment & Pensions, Intellectual Property and Real Estate & Construction.

For more information, please visit cms.law